The 3 Elements of Succession Planning for Family Businesses

Succession planning is the ongoing process of categorizing high-potential employees, evaluating and developing their skills and abilities, and preparing them for advancement into positions that are critical to the success of business operations and business objectives.

Succession planning is a human resources concept that all successful businesses should prioritize regardless of size or ownership. However, the complexities of family-owned businesses increase the need for succession planning as owners prepare to pass down their organizations to new generations or someone outside of the family unit. As a best practice, family businesses shouldn’t operate like a monarchy. The next in line for “the thrown” isn’t always the most suited for the job of leadership. Less than one-third of family-owned businesses will survive the transition from first to second generation family ownership. After the second generation, less than fifty percent will survive.

Planned and unplanned transitions such as retirement, professional opportunities outside of an organization, sudden illness, or general life changes are inevitable in any company. However, family businesses will internalize these transitions differently as marriage, divorce, the birth of a child or even the death of a relative can forever alter succession planning and family dynamics. Arguably transitions to a business and its workforce can be more difficult to cope with for family businesses because of the involvedness of personal and professional relationships. It is important to begin succession planning as early as possible to allow family business owners the time to reflect, get strategic, and avoid a crisis.

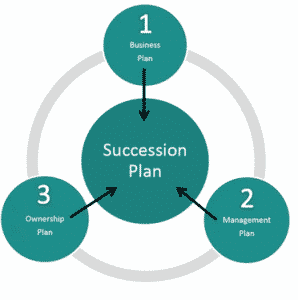

Presented are three elements of succession planning best practices for family business owners.

Presented are three elements of succession planning best practices for family business owners.

Element 1: Business Plan

Deliberate succession planning should be intended for the future state of your organization. If you already have a vision and current business plan, start with an audit. Does the direction you’ve intended for the next several years align with your industry, your talent, and your resources? A successful business plan will outline the organization’s long-term goals and objectives. Evaluate strengths, weaknesses, opportunities, and threats (also known as a SWOT Analysis) to your organization. Develop a recurring time frame, whether semiannually or annually that you can continue to update or add to your business plan as necessary. This will be the foundation of the other two elements.

Element 2: Management Plan

Management planning will likely be the most subjective of the three elements because some managers will be seasoned professionals that aren’t family members. Depending on your business and industry, you might also need to stay flexible when it comes to visualizing your talent because of changes to technology, professional trends, or even the economy. However, most key positions, like a CFO or controller, for example, will likely be needed in the years to come despite extenuating factors.

As you build a management plan, be sure that as you assess the talent needed, you are considering factors that align with your business plan, and that you are thinking holistically about your organization and its growth.

Identify key and emergency positions, skills gaps that are present, training and development needs, and any current successors. Audit your current practices, connect with a professional consultant, and openly discuss with your current leaders. A great way to get started is to assess the high performers and identify the competencies they possess. From there, consider working with a professional to establish a means to conduct assessment testing.

Element 3: Ownership Plan

Last but most important, is understanding who will take over the highest rank of ownership of the business. Prior to identifying a successor, there should already be several layers of governance of the business such as family members, non-family members of management, outside attorneys, an advisory board, etc. in existence. However, family businesses should also consider additional documentation and planning such as a family constitution, family councils, and family policies to supplement that leadership in addition to other human resources tools. To start, audit what you presently have and then engage an attorney. Begin creating a family governance structure with that legal professional.

Then as you did with the management plan, evaluating strengths, weaknesses, and readiness for the next generation of ownership. It is never too early to engage future generations of your family to assess their skills, abilities, and interest in leading your company. You may also decide to sell the company to someone outside of the family or organization or even, go to employee stock ownership. Every family-owned business will need to make a decision best suited to their interests, however, ongoing planning is a best practice. Establish timelines so that you can professionally develop your next of kin and be transparent with your business plan and management plan so that the owner’s plan can easily flow into your succession planning strategy.

Having a well-developed and current succession plan in place is important in avoiding vacancies in key positions, ensuring the stability of business operations, providing developmental opportunities, and helping to develop a diverse workforce.

Reply a Comment