By

aholaadmin

In

Payroll,

Benefits,

Employee Engagement,

Human Resources,

Managing COVID-19,

Safety,

Tax Compliance,

Employees,

Hiring

Posted

Some employees have said they don’t feel safe returning to work. Can we just replace them?

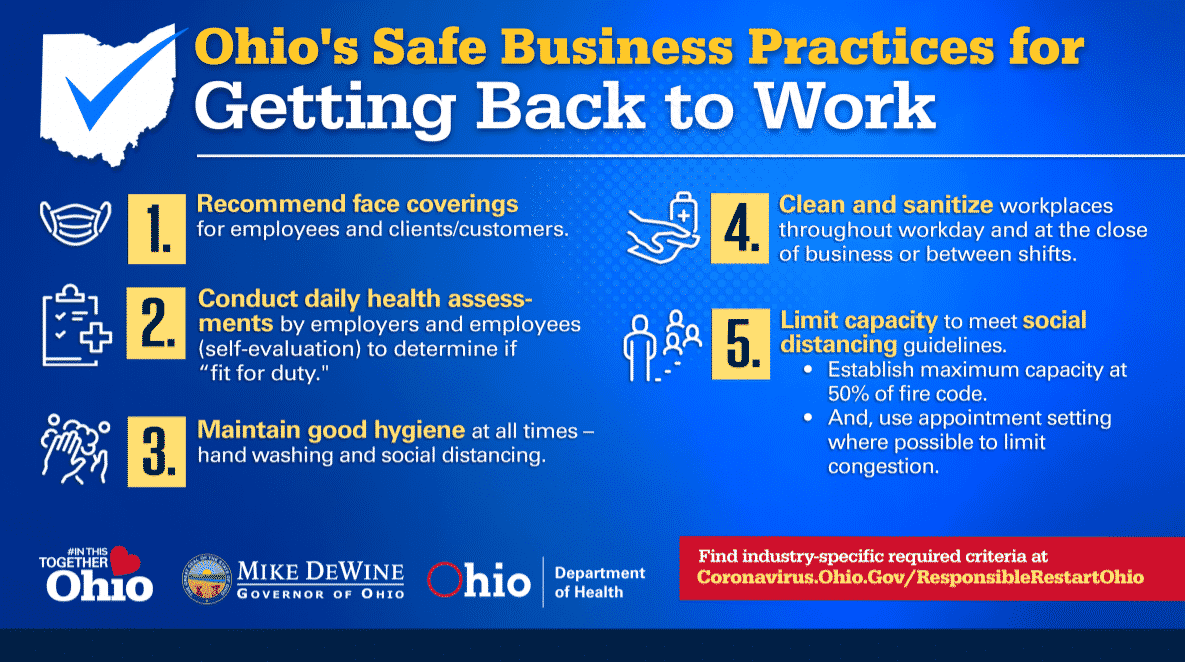

We recommend extreme caution when deciding to replace an employee who refuses to work because of...