Ohio Announces Small Business Relief Grants of $10,000

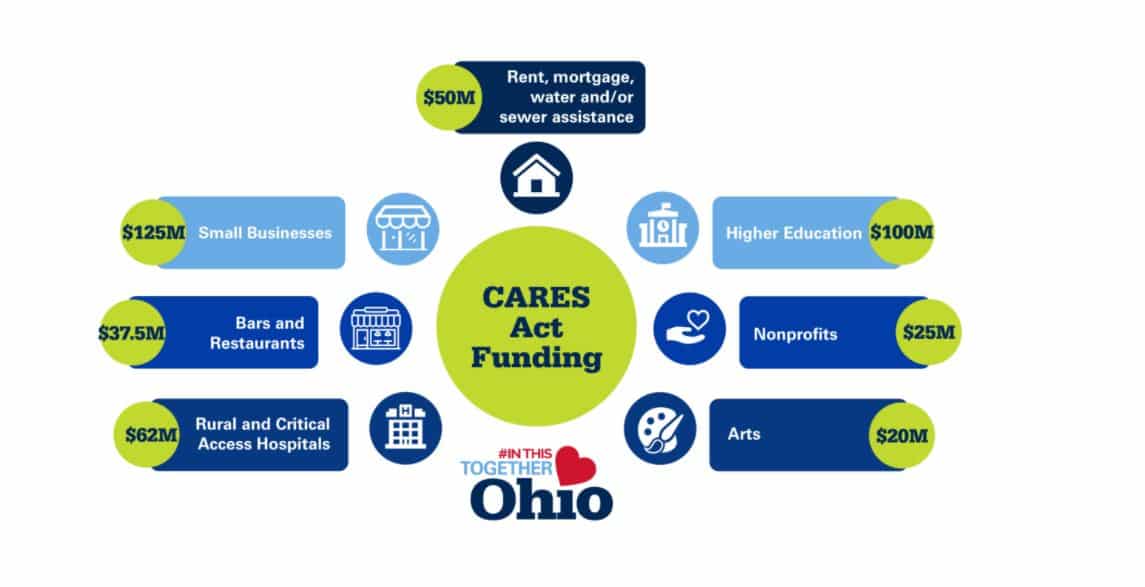

On October 23, 2020, Ohio Governor Mike DeWine announced a funding package of more than $419.5 million CARES Act funding to help Ohioans. This package includes funding for small businesses, restaurants and bars, hospitals, higher education, arts, nonprofits, and low-income Ohioans impacted financially by the COVID-19 pandemic.

The package includes $125 million in CARES Act funding to provide $10,000 grants to small businesses with no more than 25 total or full-time equivalent Ohio employees . The grants will help businesses pay for a variety of eligible expenses, including mortgage or rent payments; utility payments; salaries, wages, or compensation for employees and contractors; business supplies or equipment; and other costs. The application for the Small Business Relief Program will be available November 2, 2020 at businesshelp.ohio.gov.

Eligible Businesses

According to the Ohio Development Services Agency, eligible businesses must:

- Be a for-profit entity with no more than 25 total or full-time equivalent Ohio employees as of Jan. 1, 2020.

- The applicant business has a physical location in Ohio and earns at least 90% of annual revenue from activities based in Ohio.

- The business must have been in continuous operation since Jan. 1, 2020, except for interruptions required by COVID-19 public health orders and have the ability to continue operations as a going concern.

Eligible Use of Funds

Grant funds can be used to reimburse eligible businesses for the following expenses because of revenue loss or unplanned costs caused by COVID-19:

- Personal protective equipment to protect employees, customers, or clients from COVID-19.

- Measures taken to protect employees, customers, or clients from COVID-19.

- Mortgage or rent payments for business premises (personal residences explicitly excluded).

- Utility payments.

- Salaries, wages, or compensation paid to contractors or employees, including an employer’s share of health insurance costs.

- Business supplies or equipment

Awarding Funds

Each business that meets the criteria and submits a complete application will be eligible for a grant of $10,000 in accordance with the following guidelines:

- $44 million of the grant funds will be set aside to ensure businesses in all 88 counties receive funding. 50 businesses will be funded in each county.

- As applications are approved on a first-come, first-served basis, grants will be awarded first from each county’s allocation.

- When a county’s allocation is depleted, grants will be awarded from the remainder of funding on a first-come, first-served basis regardless of the business’ location in Ohio.

- If Development does not receive eligible applications sufficient to award all 50 grants to businesses in each county within the first 21 days after the application is opened, the remaining funds allocated to that county will be available to businesses regardless of their location in Ohio.

Application Process

The Ohio Development Services Agency is establishing an online application for the program. Businesses applying for funding will be required to establish a registration ID with the state of Ohio.

The application will be available November 2, 2020.

Read more about this announcement here.

Download Small Business Relief Grant Fact Sheet PDF.

Ahola can provide clients with the applicable reports to apply for this grant. Please contact your dedicated Payroll Specialist for assistance.

.jpg)

Reply a Comment